Children Learn Saving Basics at Maspeth Federal Event

By MOHAMED FARGHALY

mfarghaly@queensledger.com

Maspeth Federal Savings hosted a financial literacy workshop on January 13, aimed at teaching children and their families the basics of saving, budgeting and making smart money decisions, using interactive lessons designed to engage students at an early age.

The event, held at the bank’s Maspeth location, brought together children ages 7 to 11 and their parents for a hands-on seminar that blended storytelling, critical thinking and teamwork. Bank staff guided students through a “secret agent” themed activity in which participants were tasked with helping a character named Sammy make better financial choices.

“Our goal is to teach people how to save money,” said Thomas Rudzewick, president and CEO of Maspeth Federal Savings, as he welcomed families and young learners.

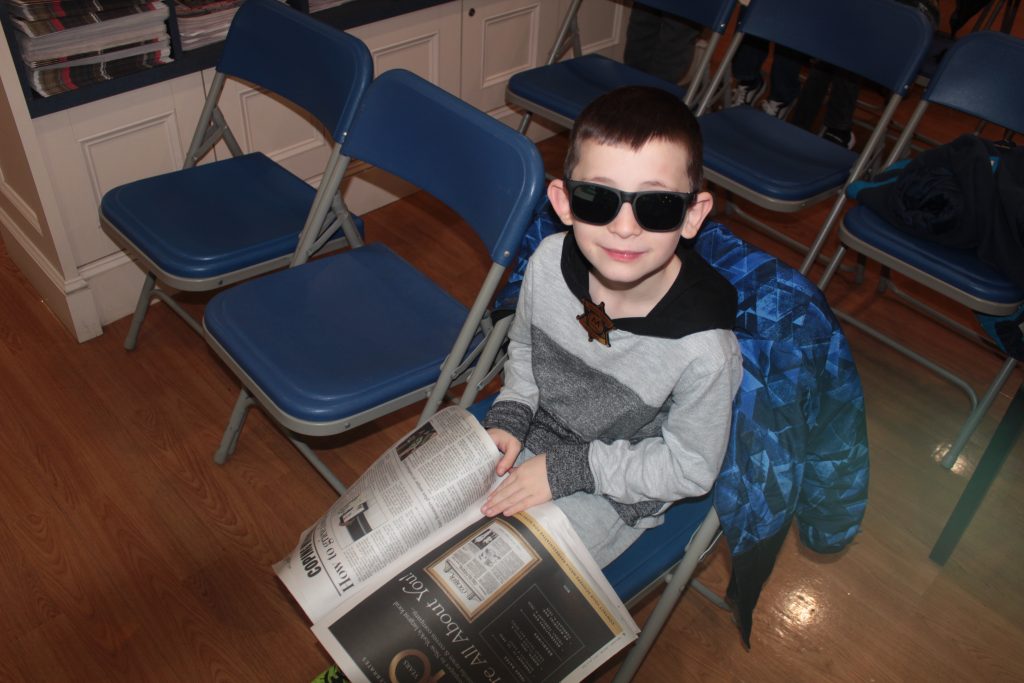

During the program, children became “Maspeth Federal Savings Agents,” using badges and role-playing to identify financial mistakes made by Sammy, a squirrel who wants to buy a $200 video game console. As the story unfolded, students were encouraged to call out poor decisions such as spending too much on candy, failing to keep money in a safe place, and giving up on long-term savings goals too quickly.

Jamie Lynn, a member of the bank’s retail team, led the lesson and explained key concepts in simple terms, including goal setting, patience and tracking spending. “Savings takes time, smart choices and patience,” she told the group, reinforcing the idea that even small amounts of money can add up over time.

Children actively participated by answering questions, raising their hands to point out mistakes, and discussing how Sammy could correct his behavior. Lessons emphasized the importance of keeping money in secure places like a piggy bank or bank account, resisting impulse purchases and staying committed to financial goals.

Parents, meanwhile, had the opportunity to speak with Maspeth Federal Savings staff about products and services designed for young savers, including youth accounts that grow with children as they get older. Bank representatives said these tools are intended to help families build healthy financial habits early and promote long-term financial independence.

The event concluded with a recap of the key lessons learned, including setting clear goals, budgeting and tracking spending. Children were rewarded with applause for their participation and later had the chance to meet the bank’s mascot, Sam the Savings Squirrel, and take photos.