By MOHAMED FARGHALY | mfarghaly@queensledger.com

Assembly Member Jessica González-Rojas praised New York State’s announcement of $350 million in supplemental payments for over 1 million low- and moderate-income families through the Empire State Child Credit program. Photo courtesy of Assembly Member Jessica González-Rojas’s Office.

Assembly Member Jessica González-Rojas today praised the announcement that New York State will distribute approximately $350 million in supplemental payments to over 1 million low- and moderate-income families. This aid, provided through the Empire State Child Credit program, offers eligible families direct payments of up to $330 per child without any application process.

The Empire State Child Credit, a refundable tax credit for income-qualified New Yorkers with children, was expanded in 2023 by Governor Kathy Hochul and the State Legislature to include children under four years old. This expansion benefits an estimated 600,000 additional children annually. The current round of supplemental payments, based on 2023 tax filings, ranges from 25% to 100% of a family’s original credit amount, depending on income.

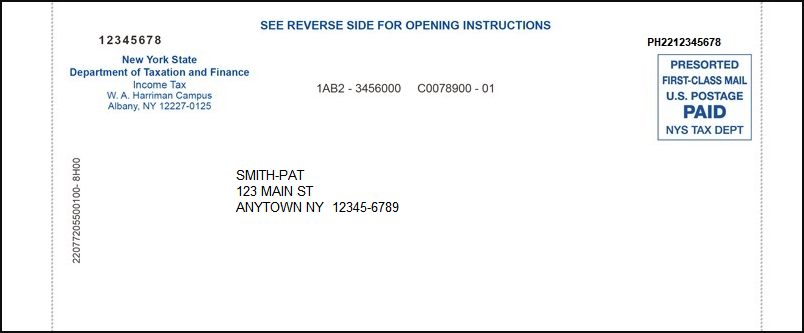

Eligible families, who received at least $100 in Empire State Child Credit for the 2023 tax year, will receive checks automatically. The New York State Department of Taxation and Finance will start mailing the checks in the first week of August and continue over the next several weeks.

Eligible families will receive automatic checks in the mail, watch your mailbox for a check that looks like this. Courtesy of tax.ny.gov

Assembly Member González-Rojas, a co-sponsor of the legislation, emphasized the importance of this financial relief.

“I’m so proud of the work we were able to accomplish this year. We fought so hard to ensure New Yorkers would receive the support and relief they need to better take care of their families,” González-Rojas said. “As the cost of living continues to rise, we have to make every effort to reduce disparities. These payments will help provide much needed relief for low and middle-income families and help address the hunger epidemic. One in ten New Yorkers, including nearly one in six children, struggle with hunger and in a state as abundant in resources as ours this should not be the case. While this is a major victory, there is much more work to be done. I congratulate my colleagues for passing the legislation and look forward to making more progress on these efforts in the upcoming legislative session.”

Governor Hochul underscored the state’s commitment to easing financial burdens for working families.

“As New Yorkers get started with back-to-school shopping for their kids, we’re putting some money back in their pockets,” Governor Hochul said. “My team is making sure these supplemental payments reach every eligible New Yorker – and I’m going to keep working every day to address the cost of living for working parents across our state.”

Since 2022, Governor Hochul and the State Legislature have provided over $2.6 billion in financial support through various programs, including the homeowner tax rebate credit, supplemental Earned Income Tax Credit and Empire State Child Credit payments, and the gas tax suspension. In addition to these efforts, Hochul recently launched a digital portal, ny.gov/childcare, to make free or low-cost childcare more accessible through New York State’s Child Care Assistance Program (CCAP).

Assembly Member González-Rojas, reflecting on her role as a parent and legislator, expressed her dedication to continuing to advocate for family-friendly policies.

“”We were able to include a supplemental tax credit that gives up to $330 per child,” González-Rojas said. “The great news is that the parents don’t have to do anything. If you receive the Empire State Child Tax Credit, you’ll just get a check in the mail. Many parents are now preparing for the new school year. So this helps put money back in the pockets of families, particularly when you often have to buy supplies and new clothes. It’s very timely and exciting.”

She also expressed gratitude to fellow Queens Assembly Member Andrew Hevesi, chair of the Committee on Children and Families, and the collective efforts of the ‘mom squad’ in the State Assembly and Senate.

“We want to make sure we’re doing everything we can to help with everything from child care to school meals to access to health care for our children,” González-Rojas said. “We’re going to keep advocating for it in next year’s budget and hopefully make it a permanent part of our budget system.I want to thank my fellow moms in the State Assembly and the State Senate. It takes a village to advocate for these policies, and the mom squad came through.”

The Assembly Member also highlighted another victory in the state budget: automatic re-enrollment for children on Medicaid or the State Child Health Plus program until age six. This policy, designed to reduce paperwork burdens for parents, ensures continuous healthcare coverage for young children during their critical developmental years.

“During those critical years, from birth until the age of six, having access to a provider and health insurance is so critical,” González-Rojas said. “This was a victory for me personally, but it was also a collective win for all advocates who care deeply about children’s health and family well-being.”

For more information on the Empire State Child Credit and supplemental payments, visit the New York State Department of Taxation and Finance’s website.