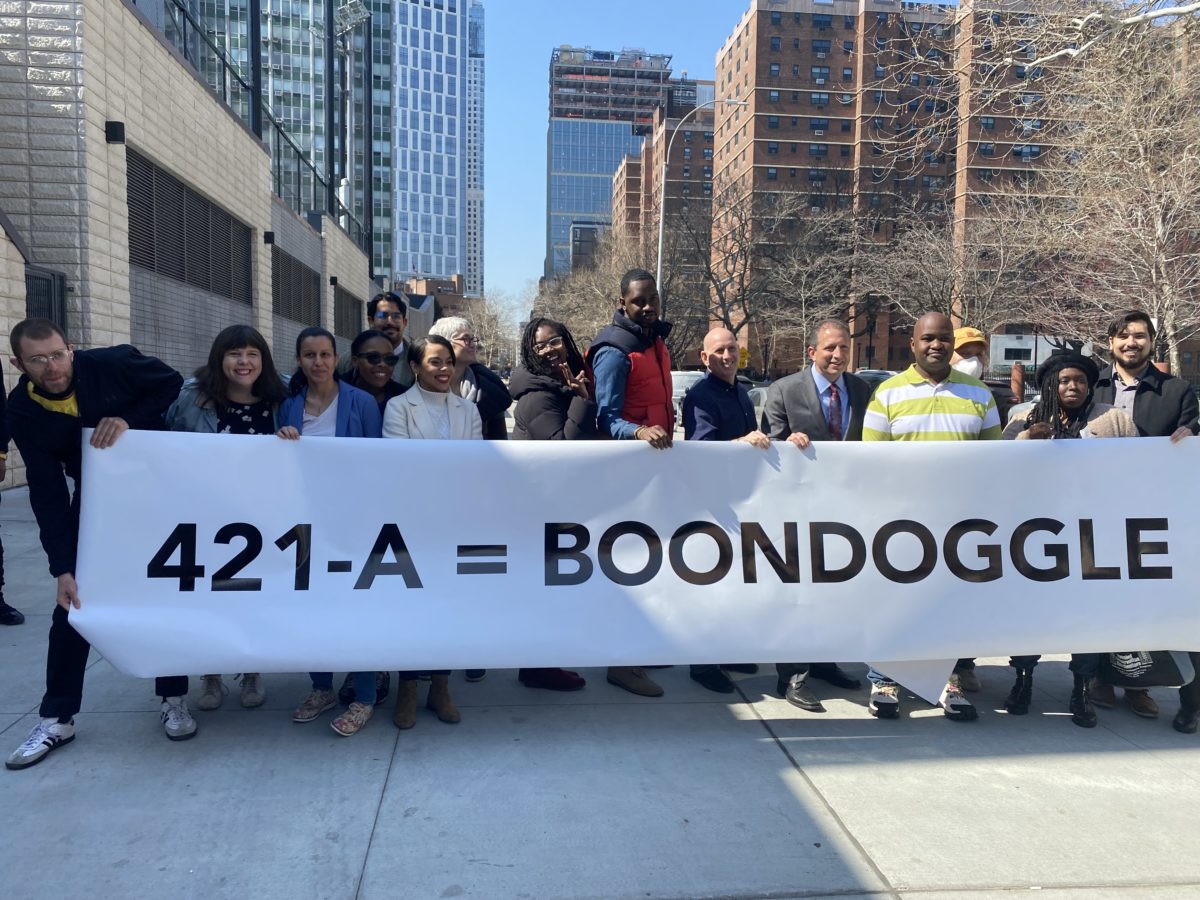

Progressives call for the end of 421-a

Progressive politicians have a new rallying cry: “421-a , let it die!”

The little-known abbreviation is a major property tax break for developers that is set to expire this summer – and the left wants to keep it that way. The 421-a tax program was created in 1971 to spurn investment when the city was lacking money. But critics now see it as an antiquated piece of legislation that gives tax breaks for developers while failing to achieve affordable housing.

Under 421-a, developers can receive tax breaks for building housing that is determined affordable at 130 percent of the average median income. In areas like Williamsburg, that means that a single adult making over $100,000 could qualify for affordable housing.

Councilwomen Tiffany Cabán and Pierina Sanchez introduced a resolution to urge the state legislature and Governor to allow the program to expire while Comptroller Brad Lander released an analysis of the 421-a that recommended its lapse and for structural property tax reform to replace it.

New York State Assemblywoman Emily Gallagher has also introduced legislation, that is currently in committee, that would give the state the power to audit potential overcharging of rents in 421-a buildings.

“421-a is not an affordable housing strategy, it’s free billions for developers. At a time when we have so many people desperately in need of vital assistance, we have absolutely got to stop this massive giveaway to the wealthy real estate interests who need it least,” Cabán said.

In recent months, Governor Hochul has proposed a new version of 421-a, called 485-w, that would make modest changes to the affordability requirements and wages for construction workers.

“Governor Hochul’s proposal was offensive: plain and simple. It’s tweaking, in the most minor and modest ways, a program that is fundamentally broken. We need to end 421-a; we need to go back to the drawing board,” Councilman Lincoln Restler said. “ We need to start investing in housing that’s going to end the homelessness crisis that’s going to make sure that each and every family in our community can afford to stay and live in our community.”

The comptrollers report found that this year the city will give up $1.77 billion in 421-a tax breaks while the city comparatively spends 1.1 billion on the city’s Department of Housing Preservation and Development.

The comptrollers report found that this year the city will give up $1.77 billion in 421-a tax breaks while the city comparatively spends 1.1 billion on the city’s Department of Housing Preservation and Development.

“So all the money the city intentionally spends on affordable housing for a wide range of people – folks who have been homeless or folks who are getting a first rung on the homeownership ladder. The whole array of HPD programs is less than we give away in 421-a tax breaks tax breaks,” Lander said.

Lander’s report features a proposal for property tax reform that would replace the 421-a program while still creating incentives for developers to build affordable housing. It includes creating a new targeted affordable housing tax incentive to build true affordability, equalize tax treatment between residential construction, and also introduce a revenue-neutral tax rate for family homes, small rental buildings as well as condos and co-ops.

The 421-a tax program is set to expire June 15th of this year and the proposed deadline for structural tax reform laid out in Lander’s plan would be in the winter of this year.