The Forgotten Patriotic Artists of Forest Hills Gardens The Voice Behind Patriotic Posters $ Bookplates Comes Alive

By Michael Perlman

Forest Hills Gardens, which was established in 1909, harbors an extensive history of residents who became known for their achievements on local to international levels. Back in 1914, the community began coordinating annual large-scale Fourth of July Festivals in an exquisitely decorated Station Square, often with activities at the Forest Hills Inn and Tea Garden, Olivia Park, and along Greenway Terrace and Flagpole Green, formerly Village Green.

One hundred and eleven years later, it is time to take a look at three of the community’s well-known artists with patriotic influences, whose success reached far beyond New York. They were Will Phillip Hooper and his wife Annie Betty Blakeslee Hooper of 84 Greenway South, as well as Herman Brown Rountree of 176 Slocum Crescent, but today they are long-forgotten.

Circa 1915

Circa 1915

Will Phillip Hooper (1855 – 1938) was a painter and illustrator who was born in Biddeford, Maine and pursued his studies in Boston and The Art Students League of New York. He founded the Hooper Advertising Service at 200 Fifth Avenue, and was a New York Watercolor Society member. Among the publications which featured his illustrations were Harper’s Weekly, LIFE, St. Nicholas, and The London Graphic. In 1892, “The Legend of The Lantern” featured his photogravures.

Annie Betty Blakeslee Hooper pursued her studies at San Francisco Art School, and then relocated eastward to study with Melville Dewey and Will Phillip Hooper. Her specialties ranged from bookplates to dinner plates, and was a remarkable patriotic poster artist. She exhibited bookplates at venues including the Pen and Brush Club of New York.

The spirit and voice of late artists educate current generations. In January 1916, she told The Christian Science Monitor of Boston, “Your book plate must try to express in symbols your occupation, special interests or hobbies. It may symbolize your home, your love of nature, your ideals, your activities, or your vision. It should be typical of you and you only, and the designer must blend all these symbols into a design which shall have both beauty and significance.” She continued, “After the design is made, it must be etched on copper or in cheaper form, on zinc, and printed on paper of fine quality. Collectors of book plates must look to the symbolism embodied in the composition, and also to the composition itself and to the fineness of line and delicacy of workmanship in its execution. Rare book plates are in demand, and those of famous people are greatly desired by the collectors, who are a growing class.” Orders for book plates were taken by first-class booksellers and jewelers who would retain plates to have a name inserted.

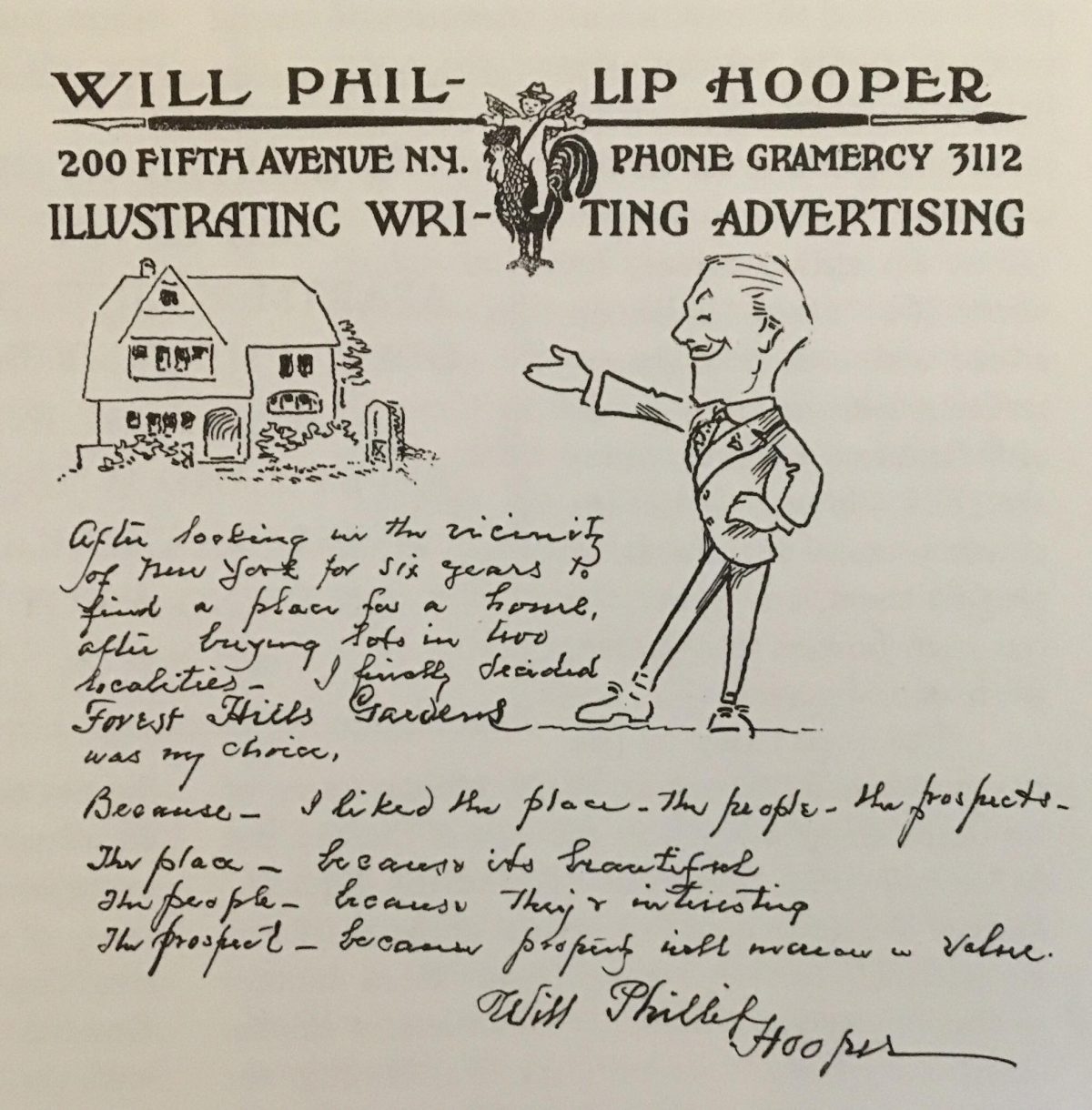

Forest Hills Gardens was six years old when “Why We Have Chosen Forest Hills Gardens For Our Home” was published at the Village Press in 1915, after W.P. Hooper originated the idea and collaborated with Forest Hills Gardens resident Frederic Goudy, a prominent type designer, artist, and printer. At the time, Forest Hills Gardens featured 166 private homes, the Forest Hills Inn which operated as a hotel with 44 live-in staff members, and the adjacent Housekeeping Apartments (renamed The Marlboro) on the west and The Raleigh on the east. Between the apartments and houses were approximately 720 residents. Hooper selectively approached residents, and 53 entries were published alongside Goudy’s typography and decorations. Spontaneous expressions of villagers were captured and complemented by half-tone illustrations of homes.

In the publication, W.P. Hooper responded to his own question: “After looking in the vicinity of New York for six years to find a place for a home, after buying lots in two localities, I finally decided that Forest Hills Gardens was my choice, because I liked the place, the people, and the prospects. The place – because it’s beautiful; the people – because they’re interesting; the prospect – because property will increase in value.”

W.P. Hooper designed a poster in 1915 featuring a continental soldier carrying the flag and leading a child. His wife Annie designed an Independence Day 1916 “A.B. Hooper” signed poster announcing the circus coming to town. It depicts a whimsical child-like clown riding an elephant, whose upwards trunk is holding a 4th of July flag over a dog on its hind legs in anticipation. The Forest Hills Gardens Bulletin read, “It is not the animal of our books on natural history. But no finer specimen of the poster elephant has ever been seen in captivity. We are profoundly impressed with the peculiar expression conveyed by the treatment of the subject’s eye. Undoubtedly Leonardo da Vinci could have made his famous Mona Lisa smile about fourteen degrees more mysterious if he had seen this elephant first. There is something intensely human about the look in the said eye, suggesting that Mr. Hooper generously contributed that feature to the design.”

A 1917 Forest Hills Gardens Bulletin features their residence that offered a studio on the first floor and a third floor for billiards. Then in 1919, the couple relocated to 51 Summer Street.

Springfield, Missouri native Herman Brown Rountree (1878 – 1946) was a painter, newspaper artist, and magazine illustrator who designed posters for early 20th century Independence Day celebrations, where he served as the Chairman of the Poster Committee. He lived with his wife Nell Lamoine Lee, daughters Helen Cynthia and Eleanor Lee, and a Cuban servant. Forest Hills Gardens principal architect Grosvenor Atterbury designed their home at 176 Slocum Crescent with a two-story rear studio, which offered much light.

The July 12, 1919 Forest Hills Gardens Bulletin stated, “Mr. Rountree is one of this country’s most brilliant poster artists.” He is depicted on an ornate and whimsical 1927 N.M.F. caricature map of Forest Hills Gardens, Forest Hills Stadium, Austin Street, and Queens Boulevard, which features an artist in front of an easel.

Rountree’s illustrations were published for the foremost authors in leading magazines such as “Gunter’s Magazine,” “Appleton’s Booklovers Magazine,” “The Sportsman,” and Frank Buck’s “Bring ‘Em Back Alive” and the “Old Warden” series in “Field and Stream.” He illustrated for the Philadelphia Public Ledger, as well as newspapers in St. Louis, and Hartford, and one of many illustrated works was “On Many Trails.” In his obituary, he was regarded as “one of America’s best-known wildlife illustrators.” His paintings of animal life encompassed race horses, polo ponies, African hunting expeditions, and western ranch life.

Rountree’s 1916 poster, “Yes Mule – It’s The Greatest Show on Earth!!” captured the expressions of astonished children watching a clown that embraced a mule, sitting on its hind legs. The bottom further captured the Gardens’ festive and playful spirit with a lineup of a frivolous clown, a dog act with a carriage being pushed, a ballerina on a horse, boxers, acrobats, as well as a dog playing an instrument while balancing on a ball next to a woman holding a baton. The Forest Hills Gardens Bulletin drew a comparison of his poster to a mural decorative style. Referencing the mule, it stated, “Its neck is beautifully garlanded with flowers, which proves that Rountree is equally at home in the vegetable and animal kingdoms, as well as in our glorious republic. Your true artist is quite impartial in his attitude toward the various forms of government.”

His 1917 poster featured Forest Hills Gardens during WWI on Village Green (now Flagpole Green) with a 48-star American flag being raised and a backdrop of the iconic Forest Hills Inn. It depicted a planned garden community as a center for American values. This is where the community dedicated a new concrete base and bronze collar for the flagpole, in which American sailors assisted in flag-raising exercises. Also depicted are village residents, including a child who is witnessing history first-hand, alongside his mother. He displayed a sign of respect by tipping his hat.

Rountree’s colorful 1919 poster features an extravagant masquerade, bright lights, and the Long Island Railroad Station of Station Square as a backdrop. In July 1919, Long Island Life referenced his poster for its unusual charm and artistic value. It read, “Each year he has donated a poster, commemorating our Fourth of July celebration. They have all been good, but this year Mr. Rountree has fairly outdone himself. This poster (the original of which is on exhibit at the Inn) is of such high quality that the committee would not resist reproducing it in color in the Bulletin. We take occasion to thank him, in the name of the residents of Forest Hills Gardens.”

He also specialized in men’s style illustration for clothing manufacturers in New York. “Mr. Rountree’s wonderfully life-like work, not only in fashion portrayal, but also as a magazine and book illustrator, has singled him out as the most brilliant of the younger school of artists. His drawings interpret superlatively well that environment of good breeding and luxurious living which many artists attempt and few – very few – achieve,” read an ad by advertising agents Sherman & Bryan at One Union Square, which secured his services. It was published in a 1907 edition of “The Clothier and Furnisher.”

Rountree’s entry in “Why We Have Chosen Forest Hills Gardens For Our Home” read, “A friend used to bore me with wonderful stories about the beauty, convenience, and general superiority of Forest Hills Gardens. So, to prove him wrong, I came out here one afternoon. Within half an hour I was explaining to him that he didn’t half appreciate the place. And now after having lived here for over two years, my wife and I feel we are in the right place on account of the convenient location, the beautiful surroundings, and above all, the good people we’ve met here.”

If readers are aware of additional posters by these notable artists, have their portraits, are aware of descendants, or would be interested in designing new local patriotic among holiday posters to continue the tradition, please email mperlman@queensledger.com