In the age of rapid technological advancement, artificial intelligence has become a double-edged sword. While it brings unprecedented convenience and innovation, it also opens doors for malicious actors to exploit cutting-edge technologies for illicit activities. One alarming trend on the rise is the use of AI deepfake technology by scammers to infiltrate and compromise individuals’ bank accounts.

Deepfake technology, which employs artificial intelligence algorithms to create hyper-realistic synthetic media, has evolved beyond its initial entertainment applications. In recent times, criminals have harnessed the power of deepfakes to impersonate individuals and gain unauthorized access to sensitive financial information.

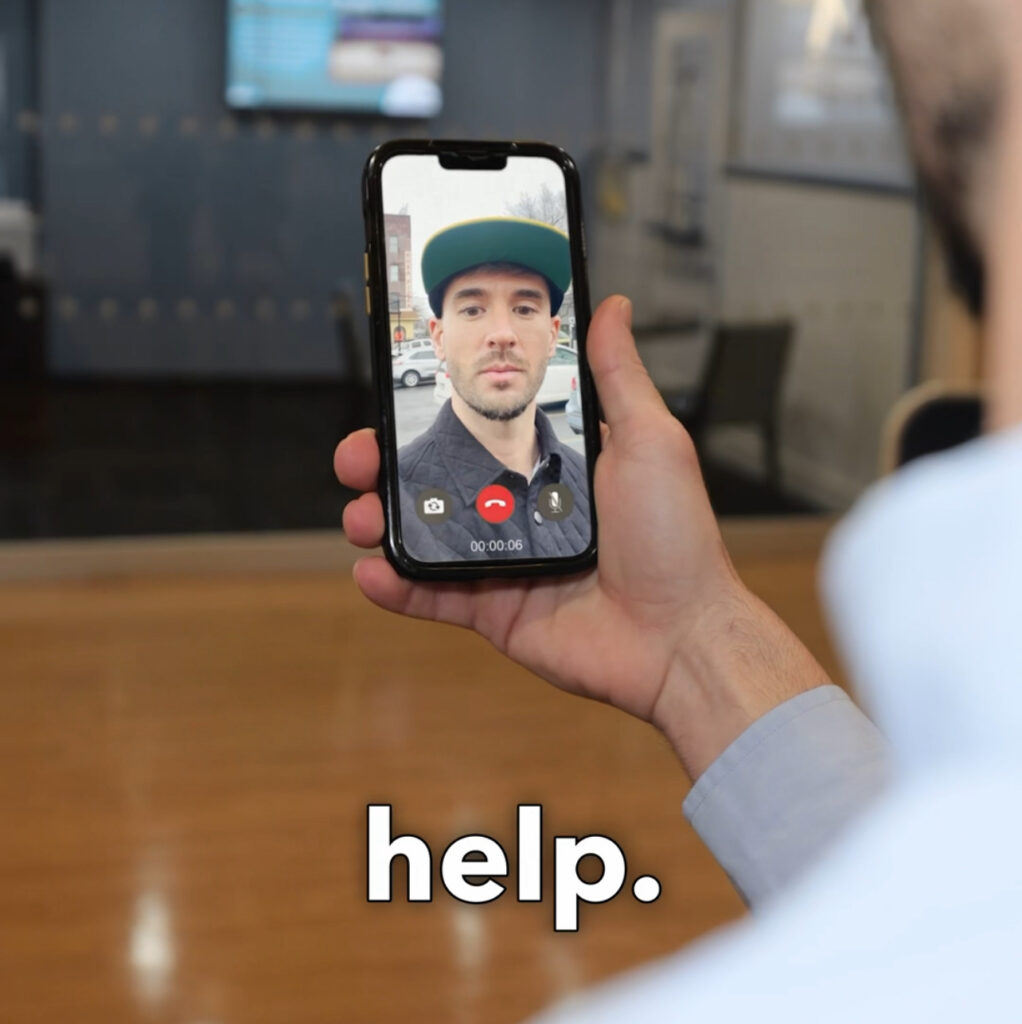

One common tactic employed by these scammers is the creation of fraudulent phone calls. Using deepfake technology, they can simulate the voice and face of trusted figures such as family members, colleagues, or even official representatives from financial institutions. Victims may receive a phone or video call that seemingly originates from someone they know and trust, making it more likely for them to comply with the caller’s requests.

Once the scammer gains the victim’s trust, they may employ various ruses to extract sensitive information. For instance, they could pose as a concerned family member in distress, claiming to urgently need access to financial resources. Alternatively, they might impersonate a bank representative seeking to verify account details for security purposes. In the heat of the moment, unsuspecting individuals may inadvertently disclose passwords, PINs, or other confidential information.

The consequences of falling victim to such scams can be severe. Hackers can swiftly access and drain bank accounts, leaving victims grappling with financial losses and emotional distress. Moreover, the sophisticated nature of deepfake technology makes it challenging for both individuals and financial institutions to discern between genuine and manipulated communications.

“The banking industry needs to be on high alert for AI-boosted fraud by constantly testing and improving their defenses. This will require ongoing vigilance, including monitoring and the sharing of insight and best practices between firms and across sectors,” said Gabriela Guallpa, a Systems Administrator in the IT department at Maspeth Federal Savings Bank.

“If you suspect that you are the target of a deepfake scam, ask the scammer personal questions, listen for voice distortions, and call the person on their normal phone number to verify,” Guallpa added.

Law enforcement agencies worldwide are also intensifying efforts to track down and prosecute those responsible for deepfake-based financial crimes. Governments and regulatory bodies are exploring legislative measures to criminalize the malicious use of deepfake technology and enhance penalties for those found guilty of exploiting it for fraudulent activities.

If you believe that you are a victim of AI fraud, contact your financial institutions immediately, change your passwords, notify necessary credit bureaus, and report the scam details to the Federal Trade Commission (FTC) at http://www.reportfraud.ftc.gov/

As technology continues to advance, society must adapt its security measures to stay one step ahead of those who seek to exploit it for nefarious purposes. The battle against deepfake-based scams requires a collaborative effort involving individuals, businesses, and governments to protect the integrity of financial systems and safeguard the trust that underpins modern society.

Kudos to banks like Maspeth Federal Savings for informing the community about AI Deepfake technology. Maspeth Federal Savings is constantly monitoring for scams, and their line is always open to those who have any questions or concerns.