Argue program disproportionately affects Black New Yorkers

By Matthew Fischetti

mfischetti@queensledger.com

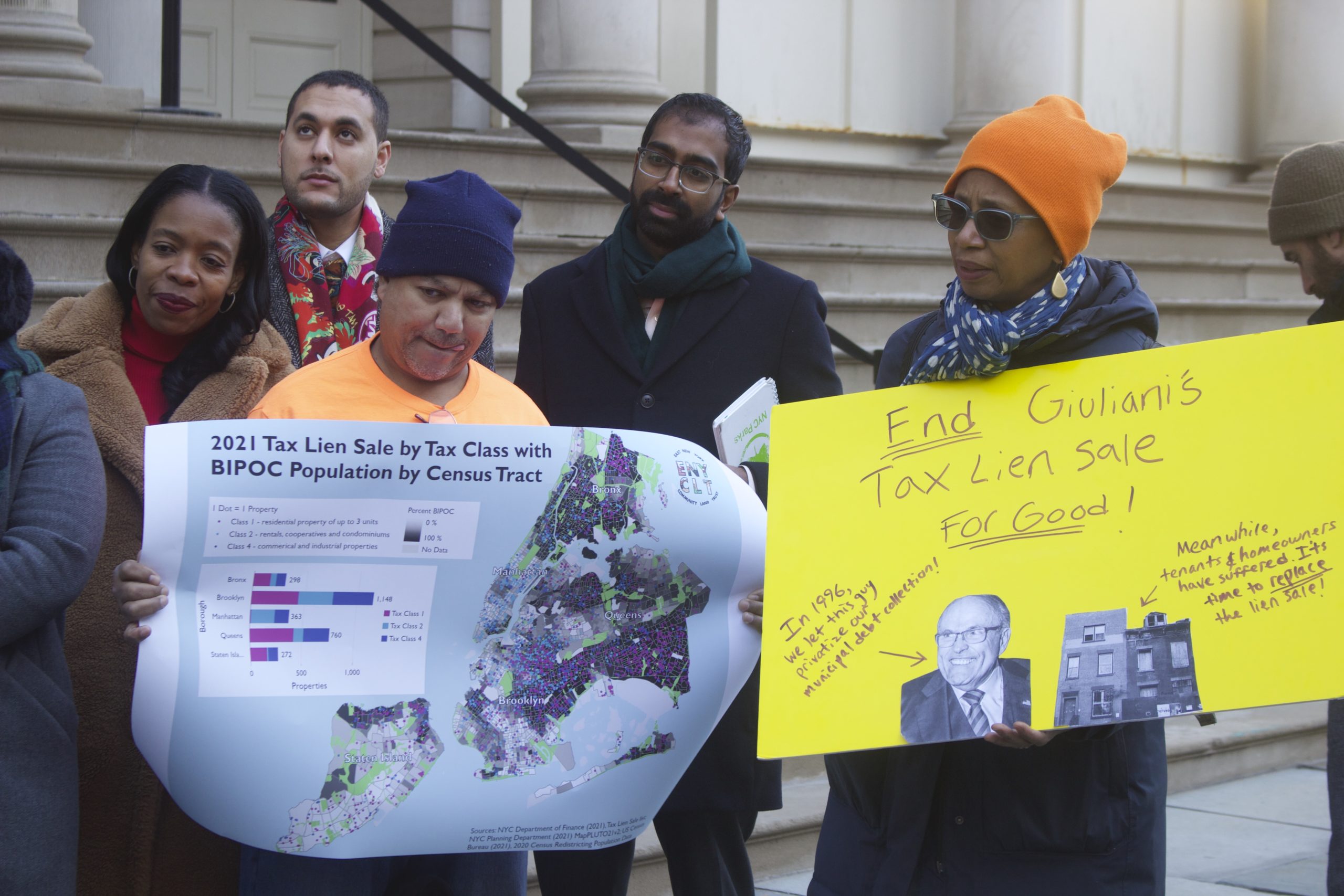

Councilmembers Rita Joseph (D-Brooklyn), Christopher Marte (D-Manhattan) and Shekar Krishnan (D-Queens) joined supporters to rally against tax lien sale.

Electeds, advocates and supporters braved the brisk weather outside City Hall last Thursday to demand an end to the tax lien sale.

The tax lien sale was first instituted in 1996, which allows buyers to purchase the debt collected by properties that are behind on municipal costs like property taxes.

“The tax lien sale is a relic of the past. It’s a relic of the Giuliani era, and it has got to be put to an end,” Fort Greene Councilwoman Crystal Hudson said at the rally. “We have the tools we need to move forward and create solutions that build our communities up rather than tearing them down, allowing low income and moderate income homeowners to live with the dignity they deserve. And in my district, specifically, we lost 20% of our black population last year.”

In 2019, the tax lien sale generated around $80 million in revenue and recouped $300 million in unpaid property taxes prior to sale, according to Bloomberg. But critics of the program charge that the sale has led to unfair targeting of low-income homeowners and communities of color.

The tax lien sale was last used in December 2021 – which generated around $145 million, according to THE CITY. Attempts to revive the sale failed in February 2022. Later on in May a majority of the council pledged not to reauthorize the sale.

On the heels of Thursday’s rally, advocates from East New York Community Land Trust, a community controlled non-profit founded around creating affordable housing in the Brooklyn nabe, released a 48 page report entitled “Leaving the Speculators in the Rear-View Mirror: Preserving Affordable Housing In NYC, a Municipal Debt Collection Framework”.

East New York Community Land Trust is just one of several organizations, including the Western Queens Community Land Trust, Brooklyn Level Up and New Economy Project, among others, that comprise the “Abolish the Tax Lien Sale” coalition.

The report outlines a framework in which a resident who has fell behind more than a year in payment would be able to either of the following: Enroll in a payment plan or tax exemption; transfer land to a community land trust in exchange for debt forgiveness, foreclosure and preservation as affordable housing with tenant protections; as well as foreclosure and sale with any funds from the sale going to the previous owner.

In order to prevent property owners from falling behind, the framework calls on the Department of Finance to increase staffing capacity, working with community based-organizations to expand their outreach as well as being communicative about potential benefits and explicit communication about what is owed.

The report also offers five different off ramps depending on property type. For Owners of occupied commercial or multi-family buildings without an indicator of physical distress, they can enter City Review – which screen them for different abatements and would be paired with a counselor to evaluate different plans. The review is specifically triggered when a property collects more than $5,000 in debt over two years.

If the review doesn’t resolve in a resolution, these same properties would move into a Municipal lien. Liens are also applied to properties with debt that exceed $5,000 over three years.

The third off ramp would be an offer to transfer lands to Community Land Trusts by transferring deeds to the land in exchange for debt forgiveness. Community Land Trusts are non-profit models of ownership in which the land is owned by a local non-profit in order to stabilize housing prices and aims to provide permanent affordability.

This offramp would be available to all property types except vacant lot owners.

The fourth option would force owners of occupied commercial or multi-family buildings without an indicator of physical distress to initiate foreclosure proceedings if other off-ramps aren’t taken. The property would be sold with funds going to the previous owner and the land transferred to a Community Land Trust.

The fifth option, offered for owners of multi-family properties in physical distress, unoccupied buildings and vacant lots would be “foreclosure and preservation.” Owners would still have to pay for “grossly-negligent” repairs and sacrifice their equity while the city pays for outstanding liens. Land from the properties would thereby be transferred to a Community Land Trust after being rezoned.

“This is one of the most pressing issues when it comes to housing justice, racial justice and economic justice and the intersection of all of these different crises,” Jackson Heights Councilman Shekar Krishnan said at the rally. “Here’s the two realities of the tax lien sale. One is a predatory practice for black and brown homeowners displacing them, while at the same time rewarding bad landlords and greedy developers exactly why the tax lien sale must be abolished.”