By Jessica Meditz

jmeditz@queensledger.com

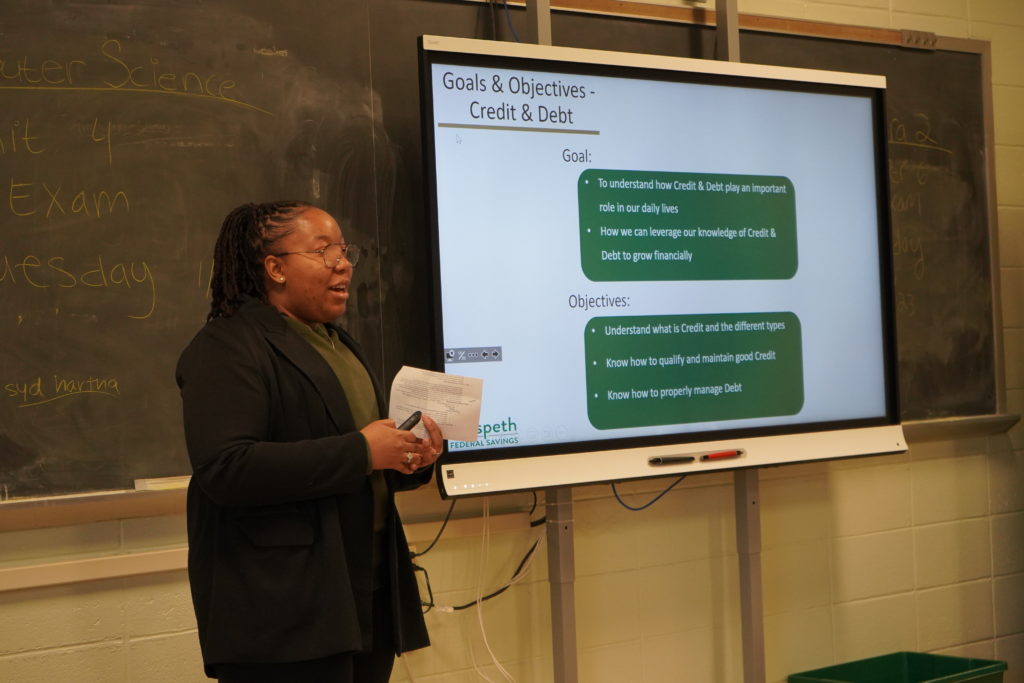

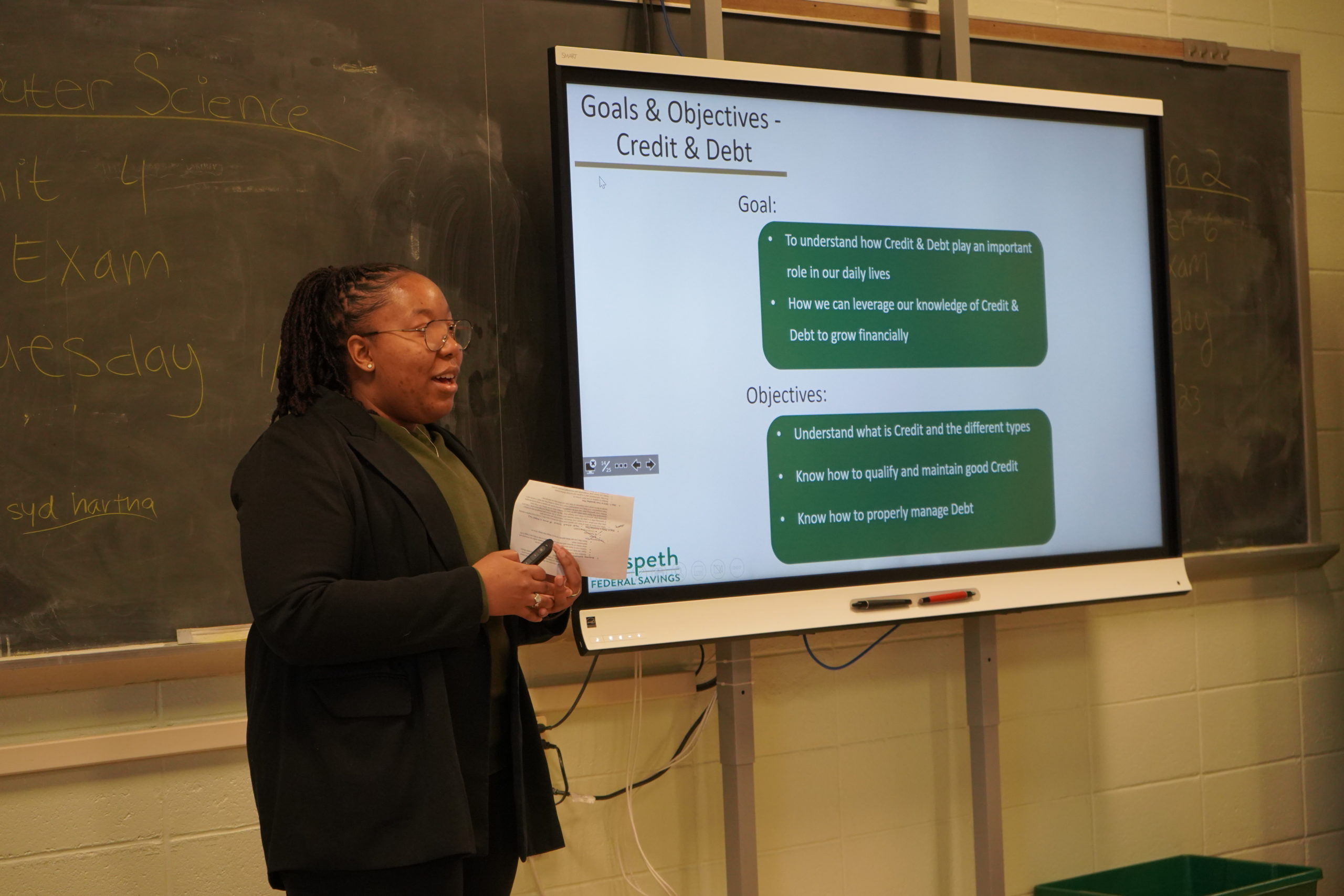

Toya Brown gives Molloy High School students a seminar on credit and debt.

Last Thursday, Maspeth Federal Savings Bank (MFS) ventured out into the community to educate students about financial literacy.

Employees of the bank visited Archbishop Molloy High School in Briarwood as part of their commitment to community involvement and sharing valuable information with youth.

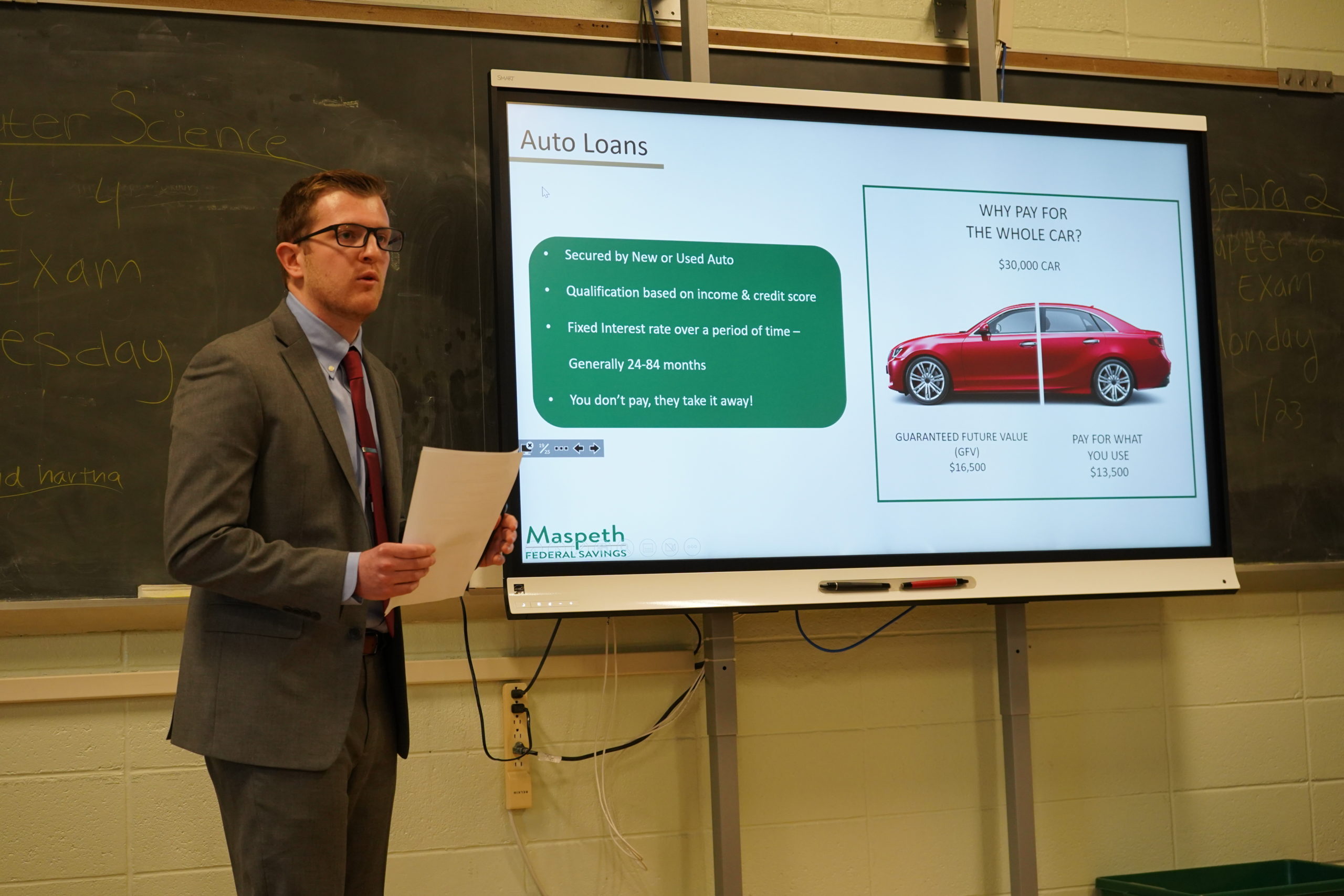

Toya Brown, assistant bank officer and executive assistant to David Daraio, senior vice president and COO, and Michael Corteo, senior credit analyst, gave a slideshow presentation to the students, sharing quintessential talking points about all things savings, budgeting and credit.

Michael Corteo’s portion of the seminar focused on savings and budgeting.

“Maspeth Federal has a very long history of giving back to the community, and one of the things that we recently started in the last couple of years was financial literacy amongst not just high schools, but colleges,” said Akshay Mehandru, vice president and credit manager at MFS. “Our goal for starting this was to educate the younger generation, providing financial literacy to them, that they may not have access to or have conversations about with their peers.”

Although he wasn’t at the most recent presentation, Mehandru has much experience giving these lessons to students.

He said that because they’re usually so busy pursuing other milestones in their lives, students don’t always have the opportunity or time to have these important conversations.

“I genuinely love talking about loans, credit and making smart financial decisions young because I’ve been there. When I was back in high school, I wanted to have something like that – I should have had something like that – but it was never brought up,” he said.

He feels it’s essential to educate young people about things such as how to get a credit card, where to save money, how to get a car loan or what loan options they have.

Brown, whose portion of the presentation included the topics of savings and budgeting, emphasized the key five steps to managing a budget – which are evaluating one’s needs versus wants, setting goals, knowing one’s income and expenses, formulating a spending plan and sticking to that plan.

“Our mission is to get young people aware of their finances: the point of having a savings and checking account, and the importance of credit,” she said. “All of this knowledge is out there, but it’s not always put into an easy way for kids these days to understand.”

Half the battle is getting children and teens to listen to this advice in the first place, and Brown is confident that the Molloy students were actively listening and engaged.

“They had a lot of questions, especially when it comes to credit…but also budgeting for college and how to save up for that,” she said.

MFS aspires to continue sharing these life lessons with Queens youth, and encourages any interested school or business to visit their website and request a seminar on financial literacy.